News & INSIGHTS

Monthly Insights Newsletter: September 2022

Patrick’s Planning Post

Is now a bad time to retire?

A recent WSJ article highlighted a question that we receive regularly when markets are temporarily depressed: does this mean I can’t or shouldn’t retire now? The real answer is that it depends, like many questions surrounding financial planning. However, it’s justifiable that declining portfolio values combined with higher living costs at the start of retirement might cause anxiety. It’s worth remembering financial markets don’t have a clue as to when your retirement will start, and they wouldn’t act any differently if they did. Those who retired during the 2008 Financial Crisis, the dot-com crash of the early 2000s, or even the late 1960s when stocks had back-to-back bear markets in ’69 and ’73, were able to retire and achieve their goals by staying disciplined and following a few rules. It’s no different this time around.

Here’s what you can do with the help of our team:

- Stress test your financial plan during bad markets: if your goals look attainable during market downturns, plans will look that much rosier when markets recover

- Do not panic sell your long-term investments (stocks): there is a reason why we call them ‘long-term’ investments

- Cut spending when markets decline: even a small adjustment to spending (say withdrawing 3.75% instead of 4%) in the first few years of retirement can have a profound effect on the long-term viability of a plan

- Add to underperforming investments: if your retirement emergency savings fund is more than sufficient, it is okay to invest some of those funds into your long-term investments. Doing so at lower prices will provide greater long-term performance and even more cash flow flexibility in later retirement years

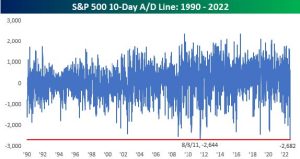

Liebman’s Library

When Sam and Mattsent this to each other simultaneously, they knew it was the perfect piece to highlight for September. They chose a recent chart from the Bespoke Investment Group a boutique research firm that the team follows closely. The chart highlights that, as of 9/26/2022, the S&P 500’s 10-day advance/decline (A/D) line dropped to its lowest level in 32 years. While no single indicator alone, in our opinion, is sufficient to drive of portfolio positioning, we do think that very negative charts like this one – coupled with the extreme bearish readings of some recent sentiment indicators – can be effective contrarian bullish indicators in the short-term.

Aaron’s Action Items

Review Your Year-To-Date Retirement Plan Contributions

As we move into October, it is important to look at your year-to-date retirement plan contributions. Remember, employer 401(k), 403(b), deferred compensation, and other similar programs can only be funded during this calendar year, as opposed to IRA and Roth accounts that can be funded in early 2023 for the 2022 tax year. A few other reminders on this topic:

- If you are under the age of 50, you can contribute $20,500.

- If you are over the age of 50, you can contribute $20,500 plus an additional

$6,500 as a catch-up contribution. - If you changed jobs this year, it is crucial to remember that your current 401(k)

plan does not know how much you contributed to the previous plan. Be careful

you don’t exceed the annual limits across both plans. - Please read this useful article for other tips and information.